Why XBTC Has Strategic Value: A Medium for Low-Cost Arbitrage and Value Storage, and XBTC’s Role in DeFi Hedging and Low-Fee Solutions

• By vski5 • 6 minutes readWhy the Emergence of XBTC on Sui Is Strategically Important

XBTC is an on-chain Bitcoin equivalent token launched by OKX, following a strict 1:1 reserve mechanism. For every 1 XBTC minted, 1 BTC is locked in OKX’s Bitcoin reserve.

Users can withdraw Bitcoin from their OKX exchange account to the Sui network and receive XBTC at a 1:1 ratio.

XBTC can be flexibly used in DeFi applications, and its value is always pegged to native Bitcoin.

LTDR – This brings four main advantages:

- Provides an extremely low-cost hedging solution, enabling users to earn stable yields through short hedging and options strategies.

- As an OKX-issued asset, XBTC’s seamless integration with the exchange significantly lowers capital inflow/outflow barriers and costs.

- XBTC introduces Bitcoin—more conveniently than mappings like LBTC—into the Sui ecosystem, as the most important store-of-value asset.

- XBTC helps redirect some native Sui users toward OKX.

How It Differs from Other Wrapped BTC Tokens

In short, OKX-custodied XBTC emphasizes ease of use and high liquidity, while other solutions, such as the upcoming sBTC bridged via the Stacks network, focus on decentralized security.

Multiple BTC wrapping schemes on Sui are complementary.

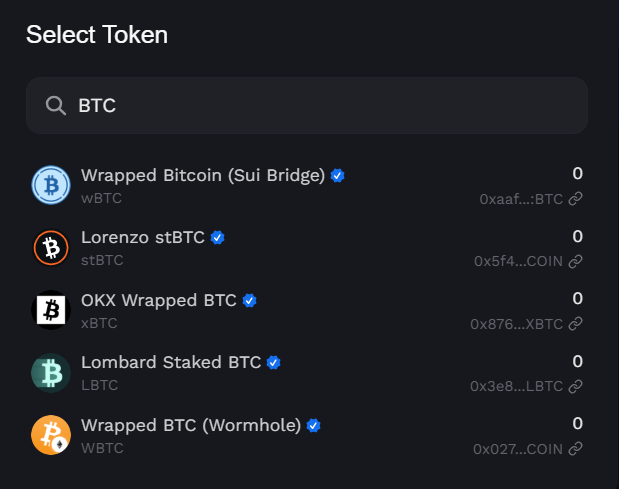

BTC tokens on Sui include:

- Wrapped Bitcoin (Sui Bridge): Appears decentralized, features native Sui bridging.

- Lorenzo stBTC: Decentralized, supports BTC liquid staking with yield.

- OKX Wrapped BTC (xBTC): Centralized, features multichain DeFi support and zero-fee minting.

- Lombard Staked BTC (LBTC): Appears decentralized, enables cross-chain staking and yield generation.

- Wrapped BTC (Wormhole): Decentralized, permissionless cross-chain transfer, enables BTC movement across chains.

XBTC’s ability to be minted or redeemed directly through a CEX, without relying on third-party or cross-chain bridges, is a major advantage.

As is typical on Sui, assets often have multiple bridged versions of the same token, which only feeds the DeFi swap revenue flywheel.

Attracting whales and institutions: Backed by OKX as the issuing platform, XBTC naturally holds trust and liquidity advantages. OKX’s centralized custody and deep liquidity lower hedging costs and security concerns for institutional users. Coupled with high-yield opportunities, XBTC helps draw more capital into the Sui ecosystem.

Whales can also choose to lock BTC into XBTC for the long term to participate in high-yield marketing-focused DeFi opportunities on Sui, while still preserving the asset’s value.

XBTC Hedging and Low-Fee Strategies

This is the most critical part: XBTC bridges CEX and on-chain liquidity, making convenient hedging and low fees possible.

Funding Rate Basics

Perpetual contract funding rates are periodic payments between long and short positions to maintain parity between futures and spot prices.

When the rate is positive, longs pay shorts; when negative, shorts pay longs.

On most major CEXs, BTC’s baseline funding rate is around 0.01% every 8 hours—roughly 0.03% per day.

As the cornerstone of the crypto market, Bitcoin’s funding rate is among the most stable and relatively low of all assets.

Assuming a 0.01% funding rate per 8 hours, the annualized yield is around 11%. This provides a stable basis for hedging strategies.

Whether the funding rate is positive or negative, this strategy remains viable. Positive rates result in additional yield.

XBTC Hedging

Short Futures Hedging Strategy

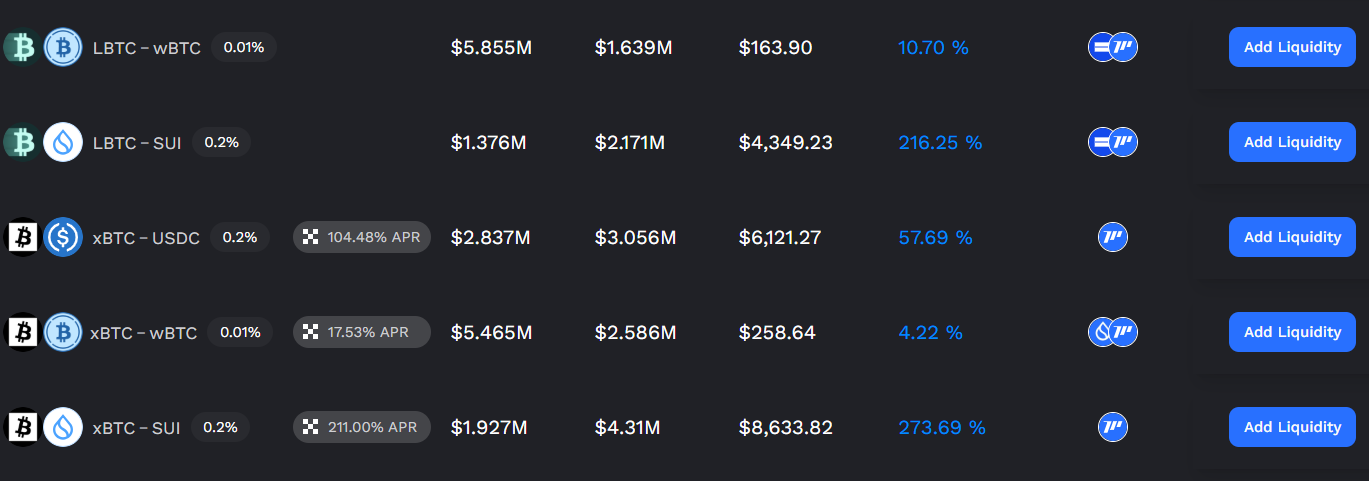

From the chart, one can see it’s possible to provide LP between two BTC variants—earning LP yields while neutralizing price exposure.

On Sui, a neutral hedging combo with XBTC includes:

- Holding a long XBTC position: on the Sui network.

- Shorting BTC futures: on a perpetual futures market.

- Providing LP: deposit XBTC into LP pools to earn yield, e.g., participate in MMT Finance airdrops.

The main advantage of this market-neutral strategy is full price risk hedging. Since XBTC is pegged 1:1 to BTC, the long and short positions cancel each other out.

This leaves LP fees and potential airdrops as stable income sources.

The strategy forgoes BTC upside in exchange for LP and airdrop yields.

Estimated opportunity cost: if BTC is currently $110K and 2026 BTC futures trade at $150K, the implied one-year APY is (150/110 - 1) = 36%.

This means the strategy would need to yield more than 11% (funding) + 36% (BTC upside) = 47% to outperform simply holding BTC.

However, funding rates are often positive, meaning shorting earns you 11% interest instead of costing it. In that case, only 36% - 11% = 25% is needed to match the upside.

Optimizing Hedging Cost with Options Strategies

Collar Strategy Explained

The collar strategy is a popular cost-optimization method. LPs are essentially grid-like in nature, and this strategy acts like a hedged LP:

Structure:

- Long XBTC (or equivalent spot BTC)

- Sell high-strike call options (collect premium)

- Buy low-strike put options (pay premium)

Example:

- Hold 1 BTC: worth $110,000.

- Sell $119,000 call: receive $1,460 premium; if BTC rises above $119,000, BTC is called away. Max upside = $10,460.

- Buy $101,000 put: pay $1,100 premium; if BTC falls below $101,000, can sell BTC at $101,000.

- Net income: $360 ($1,460 - $1,100)

| BTC Price Range | Action | Net Outcome |

|---|---|---|

| < $100,000 | - Exercise put: sell XBTC at $100,000 - Call not exercised: keep $1,200 premium | $100,000 - XBTC value + $300 |

| $100,000 - $120,000 | - Neither option exercised | XBTC value + $300 |

| > $120,000 | - Call exercised: sell XBTC at $120,000 - Put expires worthless | $120,300 |

Other strategies include Straddle and Strangle depending on one’s market view.

AI Recommendations:

| Strategy Type | Description | Suggested Platforms |

|---|---|---|

| Short Straddle | Sell same-strike Call + Put, earn double premiums if flat market | Deribit, Aevo |

| Iron Condor | Construct limited-risk volatility short structure | Lyra, Ribbon |

| Calendar Spread | Sell near-dated, buy far-dated options, bet on time decay | Aevo, Dopex |

| Event Options | Position around key events (ETFs, halving) using straddles/strangles | Deribit, OTC platforms |

Extension: USDe and Algorithmic Stablecoin Hedging Structures

BTC hedging and yield design are inspired by USDe and algorithmic stablecoin hedging structures.

USDe, by Ethena Labs, is an innovative algorithmic stablecoin that marked a breakthrough in stablecoin evolution. Unlike overcollateralized stablecoins like DAI, USDe uses delta-neutral financial engineering to maintain dollar-pegging while delivering yields above market averages.

Its core mechanism is not just collateral backing but a mix of on-chain hedging, staking, and funding rate capture to balance stability and yield.

Issuance Structure: Building a Delta-Neutral Position

USDe issuance involves:

- User deposits ETH as collateral

- Protocol mints USDe 1:1 based on ETH value

- ETH is staked via LSTs (e.g., Lido, EigenLayer) to earn base yield (~3-4% APY)

- Protocol shorts an equal amount of ETH perpetuals on CEXs (Binance, OKX) or DEXs (dYdX)

- This creates a delta-neutral position capturing staking and funding income

This structure allows USDe to maintain its dollar peg while earning unusually high returns for a stablecoin.

The key: it’s highly convenient.

Multi-Dimensional Yield Structure: What Powers the High APY?

Under certain market conditions, USDe can offer 30–40% APY, sourced from:

| Yield Source | Description | Est. APY |

|---|---|---|

| ETH Staking | Base PoS yield via Lido, etc. | 3–4% |

| Perpetual Funding | Earnings from shorting ETH when funding is positive | 8–20% |

| Arbitrage | Cross-exchange/market price inefficiencies | 2–10% |

In bullish markets with high funding rates, the protocol earns interest as a short—becoming a major revenue driver.

Risk Management: Automated Hedging and Rebalancing

To preserve peg and asset safety, USDe includes:

- When ETH rises: Staked ETH gains, short loses—net delta neutral

- When ETH falls: ETH loses, short gains—still neutral

- Dynamic hedging: Positions adjusted in real-time based on volatility and funding

- Rebalancing: Periodic or trigger-based to avoid directional exposure