Technical Explanation of Why Polymarket's Binary Options Market Was Manipulated by Whales: Starting from the Failure of the UMA Oracle

• By vski5 • 6 minutes readTable of Contents

- Polymarket and UMA Oracle: Two Stories of Collective Decision-Making Failure

- I Really Admire Polymarket

Polymarket and UMA Oracle: Two Stories of Collective Decision-Making Failure

The incident began with a controversial binary option on Polymarket: Demand Accountability for Suspected Manipulation on Polymarket TikTok Ban Vote

This option involved whether TikTok would be banned in the United States before May 2025. If banned, those who voted YES would receive the corresponding reward. The final vote was YES, which was controversial, with opponents arguing that a decision should be postponed until May. This is due to the following facts: one day after the Biden administration’s order to ban TikTok went into effect, under Donald Trump’s intervention, TikTok announced it would maintain access for 75 days. Trump temporarily suspended the ban to negotiate an agreement with ByteDance.

Polymarket relies on data from UMA’s Optimistic Oracle to determine results, with a dispute mechanism activated in case of controversy. However, in this binary option event, the dispute process was bypassed, and the possibility of whale manipulation increased infinitely.

The event occurred on the blockchain and cannot be changed. However, in another controversial event involving Barron Trump’s alleged participation in the Meme coin market in June 2024, Polymarket compensated affected users.

Of course, like a classic meme, most people would vote that “truth is in the hands of the few”. Controversy is normal, and simple errors and disputes won’t discourage people. But after whales bet over 10 million for less than a 1% profit, the resulting abnormal outcome is enough to make people angry.

We can’t assume manipulation just because of large investment, such as Theo’s bet on Trump, or the user named Chad who bought about 5 million in options through 200 transactions near the end. Whales don’t seem to need such patience in purchasing.

Another market manipulated by whales: https://polymarket.com/event/trump-declassizes-jfk-files-in-first-week

What is Polymarket

US law stipulates that casinos contain three core elements: first, betting, where participants must pay money; second, chance, where winning and losing depend on luck rather than skill; third, prizes, where participants may obtain returns.

Polymarket appears to meet these elements. Participants bet, for example, participant X bets 20 cents on YES in an event with 20% YES and 80% NO, and there are prizes - participants win one dollar if they win, but winning and losing do not depend on luck.

Polymarket more closely resembles the US Commodity Futures Trading Commission’s definition of binary options. Unlike traditional casinos, Polymarket is more like a precise financial instrument that transforms uncertainty into tradable assets.

Binary Options on Polymarket

On Polymarket, the future returns of options are standardized to one dollar. The trading process seems simple but contains complex game theory:

- Users can choose “yes” or “no”

- Bet amounts range from $0.01 to $1

- When the total bet from both sides reaches $1, the option becomes effective

A vivid example: Imagine a coin toss bet. In 10 seconds, the coin will determine the winner, with the winner getting one dollar. If you bet $0.1 on heads, and another participant is willing to bet $0.9 on tails, the option is established.

Why UMA Oracle is Not Trustworthy

But how to ensure these seemingly random results are fair? This is where the UMA oracle comes into play. It provides a decentralized truth verification mechanism:

Data Request Process

- Smart contract initiates data request

- Proposer pays token deposit

- Enter two-hour challenge period

Democratic Adjudication

- 24-48 hour debate period

- UMA token holders vote in dedicated channels

- Final result determined by democratic vote

- Winning side can claim opponent’s deposit

But these conditions are idealistic and unreasonable. The result is not necessarily correct, but it will definitely be approved by the party with more tokens. I’m reluctant to say it’s community-approved because the UMA mechanism is not influenced by the majority or by the smartest people.

First, decentralization itself contradicts KYC. Most blockchain advocates oppose KYC. Determining votes by address count is meaningless, and determining by token count is easily controlled by whales.

UMA’s Co-Founder, Hart Lambur, mentioned in this article that one UMA token represents one vote, which means whales can easily control the market.

Just as I mentioned in the US Election Special, the meaning behind gamblers’ judgments and real money bets is more worth pondering than media propaganda.

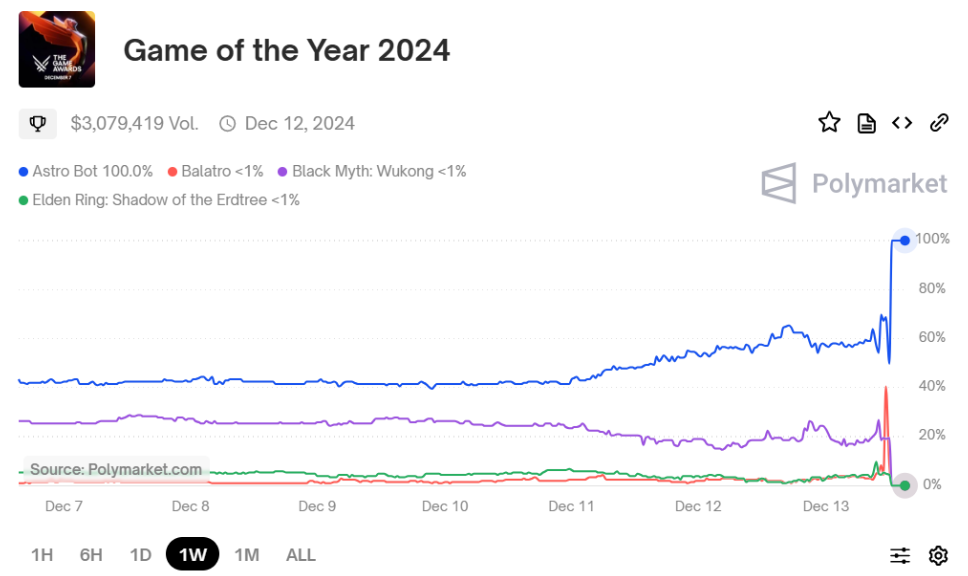

For example, in The Game Awards Annual Best Game Special, in the selection of Game of the Year, no normal player would think ‘Astro Bot’ would be TGA’s Game of the Year 2024. But looking at the odds, from the beginning, this was the only answer in the eyes of money.

This doesn’t suit the argument that “we can’t trust money’s morality, but we must trust money’s insight”. This result could be a political compromise, but it’s more likely that insiders know the answer. The unreasonable result about TikTok is the same.

In the article by UMA’s Co-Founder, Hart Lambur, he mentioned the main prevention method is to make the cost of corruption [CoC] > [PfC] profit from corruption. This is ridiculous. Setting aside the vague and unclear details of this plan, UMA, you are an oracle! As long as the oracle is manipulated to influence the results of some external decisions dependent on it, the external gains can definitely find a way to exceed UMA’s internal losses.

I see that some are protesting the Polymarket result, but Polymarket itself is a collection of smart contracts. The company only operates the frontend, and anyone can write a frontend to call the contract. Beyond this, many event descriptions are very blurry, which makes the fairness of the result a joke.

I Really Admire Polymarket

Polymarket’s structure is a surprise I’ve never seen before.

- Independent of traditional organizations

- Automatically run

- Can handle highly virtualized content

But:

- Difficult to fully integrate into human society

- Challenges in handling physical assets

- Only changes production relations without improving productivity

This matter is very “Hayek-like”. The market hasn’t failed because you must understand that the UMA oracle model never intended to establish a fair model, but to promote the interests of those holding the most tokens. This mechanism was not established for a just market, but to create a market controlled by capital. The market hasn’t failed; it has gone in the direction it should.

Going all-in is not necessarily wisdom, but understanding the behavior of going all-in definitely requires wisdom.

Polymarket is not just a casino, but an experimental field of human collective intelligence. It shows how decentralized platforms can redefine the value of information outside traditional public opinion control.

It’s just that currently, it can’t escape capital’s influence. From Karl Marx’s perspective, production relations as the “shell” of productivity can both promote and hinder productivity development. Current blockchain technology is like an not yet fully mature “shell” that provides a new organizational form but has not fully released productivity potential. As Marx emphasized, the fundamental of productivity lies in human creative labor. Blockchain is ultimately just a tool, and the key is how to use this tool to release human potential.

I hope to have the opportunity to witness the new form of financial and information warfare.