The First Blockchain I Chose, HECO, Is Shutting Down

• By vski5 • 5 minutes readI’ve been helping some people who have assets on the HECO chain but don’t have HT for gas fees.

Since most mainstream exchanges have stopped HT deposits/withdrawals and paused HECO asset trading, gas fees are a real challenge for newcomers who don’t realize their assets are on a blockchain called HECO - they only know their assets are in a wallet called “Token Packet”.

When helping those who come to me for assistance, I usually suggest using MDEX’s cross-chain bridge to rescue their assets. In many cases I’ve encountered, many small tokens have already removed their liquidity pools. For pools that still have liquidity, the slippage to move assets out can be terrifying, like with ETH.

Today I met another newcomer seeking help. I sent them some gas fees as usual, but while walking them through how to rescue their assets, I somehow decided to check the MDEX website again and was shocked to discover HECO is shutting down. This was my first blockchain, and Huobi (now HTX) was my first exchange, so I must document my story with HECO and Huobi.

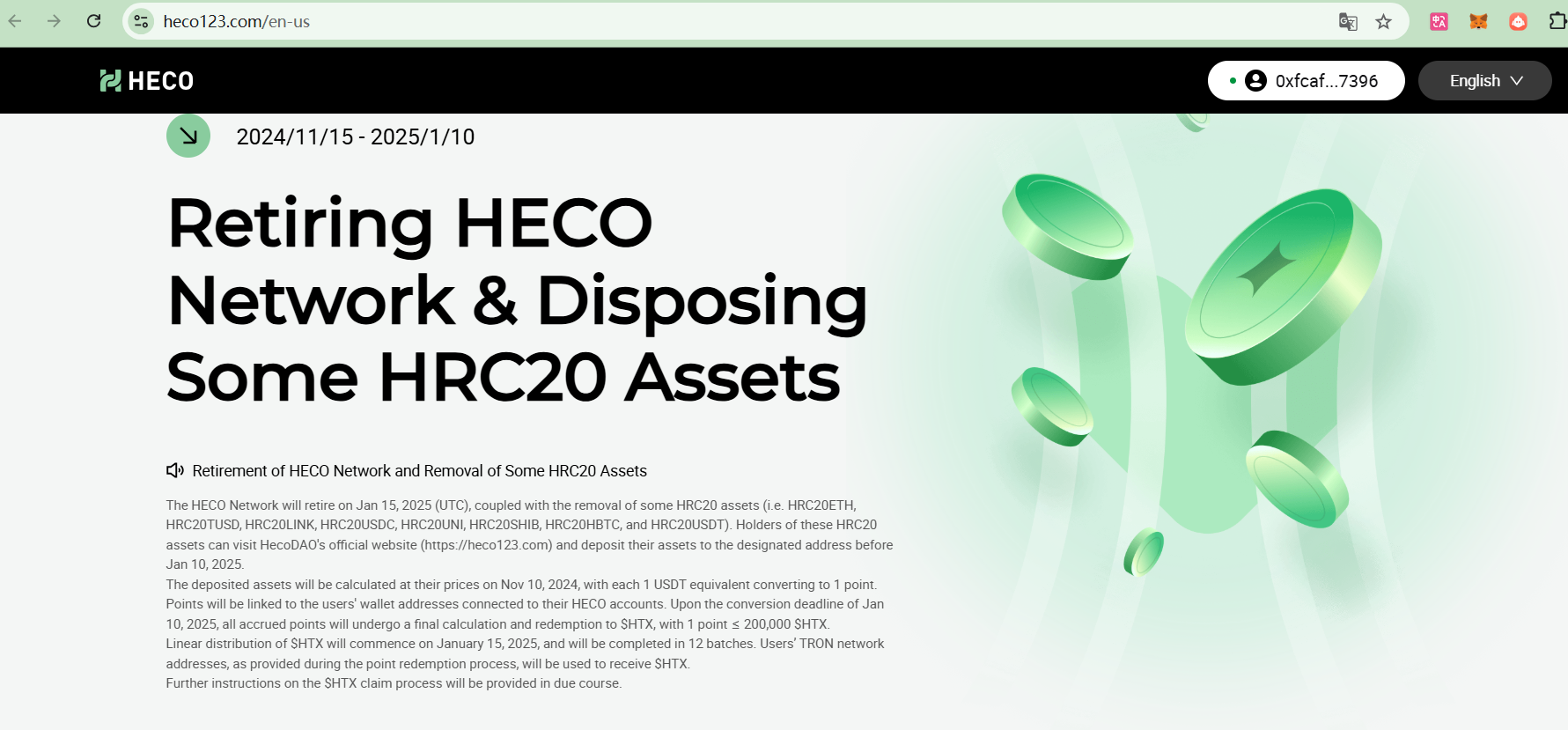

According to HECO’s official description, the only tokens they now recognize value for are (), and since Huobi’s owner is now Justin Sun, as a TRX OG, it makes logical sense that he’s linking HECO asset redemption to TRX20. Although detailed token-to-points exchange ratios were provided, they only specified the maximum exchange ratio between points and HTX (Huobi’s new exchange platform token). This might be to prevent base assets from becoming insolvent. Another haircut to take.

Retirement of HECO Network and Removal of Some HRC20 Assets The HECO Network will retire on Jan 15, 2025 (UTC), coupled with the removal of some HRC20 assets (i.e. HRC20ETH, HRC20TUSD, HRC20LINK, HRC20USDC, HRC20UNI, HRC20SHIB, HRC20HBTC, and HRC20USDT). Holders of these HRC20 assets can visit HecoDAO’s official website (https://heco123.com) and deposit their assets to the designated address before Jan 10, 2025. The deposited assets will be calculated at their prices on Nov 10, 2024, with each 1 USDT equivalent converting to 1 point. Points will be linked to the users’ wallet addresses connected to their HECO accounts. Upon the conversion deadline of Jan 10, 2025, all accrued points will undergo a final calculation and redemption to $HTX, with 1 point ≤ 200,000 $HTX. Linear distribution of $HTX will commence on January 15, 2025, and will be completed in 12 batches. Users’ TRON network addresses, as provided during the point redemption process, will be used to receive $HTX. Further instructions on the $HTX claim process will be provided in due course.

My Liquidity Mining on HECO

I first encountered airdrops on HECO’s Cocoswap, where you could get airdrops just for interacting with DeFi or even just having token transfers appear on the blockchain explorer.

Later, with the popularization of blockchain data services like Dune, anyone who could write simple SQL could find addresses that met project requirements and could fake looking like their project was hot and valuable.

Getting airdrops became increasingly difficult. As market share filled up, the days of getting rich overnight were gone. Airdrop players could start to know the amount of tokens they could get, then later could only get points with unknown token exchange ratios - the bad days had arrived.

Some DeFi projects I encountered in 2021 brought me airdrops, but I wasn’t aware of this and didn’t even have the mindset to run away quickly while they had value - all the tokens went to zero.

Without capital, I only thought about doing liquidity mining in DeFi, and couldn’t see what should be done with small amounts - flipping memecoins and farming airdrops.

I can read 10-K Red Flags, understand EV/EBITDA, P/TB, P/E, value hidden for tax avoidance, write Value Analysis, yet couldn’t profit in crypto.

Buffett also started out by making big, high-impact investments early on; essentially, he was flipping penny stocks.

Story of a OG Who Got Rich Overnight on HECO

I met an OG who made his first bucket of gold on HECO, not through DeFi liquidity mining but by speculating aggressively. He caught an opportunity in the HTMOON (abbreviation for Huobi Token to the Moon) phenomenon, entering with thousands at midnight and exiting with millions.

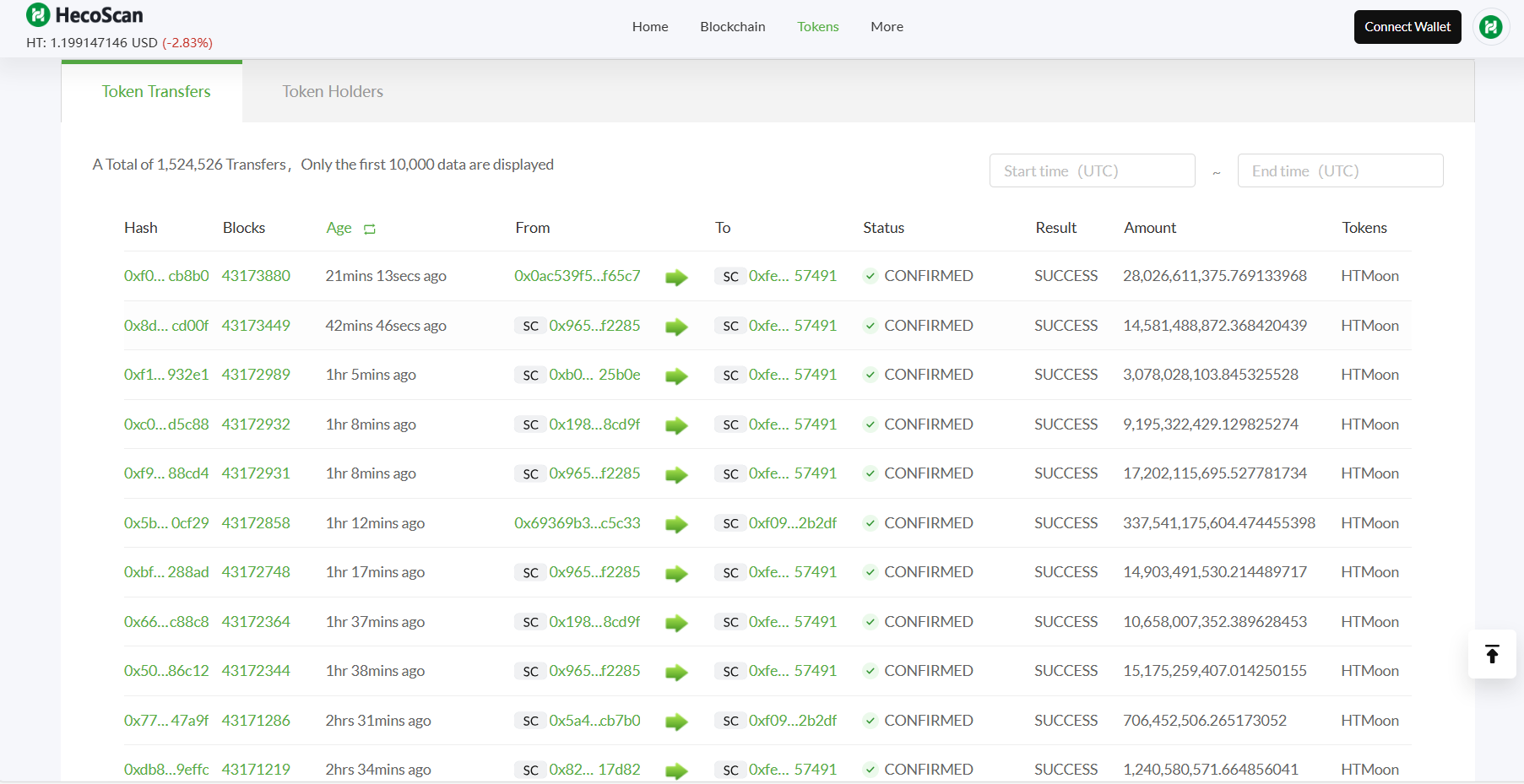

The largest two position increases

When this OG entered the industry, you could still get information on Chinese social media Weibo, and many promotional platforms and exchanges were still in China.

The OG's first trade was buying Lion after seeing a signal on Weibo and learning how to trade on-chain.

0x383f875c12e2cac5ec519393810e1a23580d8a81ba22d52f5157b8f657b04688

The OG also did liquidity mining, but he was quick to react and change direction timely. At the time, SHIB bought on exchanges couldn't be withdrawn to HECO, so he bought SHIB on-chain and did liquidity mining for about ten days on MDEX and GOFF. Now only MDEX barely survives on BSC among these DeFi platforms.

0xfa1c1594dc0ad3a5775ce8339818c58ac5cd48c92fa9471813bbbac1b7c03d3e

Ending

This is a regretful but simple story, without many morals but full of dreams of getting rich.

Reminiscing about the past is characteristic of old people, as young people have more time in the future to look forward to.

While still young, do something, catch the last bull market.

Epilogue

Today is January 9th, 2025, and I’m taking one last look before HECO shuts down.

HTMOON continues to show transfer activities even in HECO blockchain’s final moments. I believe these are the lingering traces left by the earliest automated market manipulators.

Token transfers and active holder addresses have always been the key metrics projects boasted about. Now, even lazier and greedier developers have created yield-bound airdrop NFTs that allow them to profit in advance while simplifying the selection process.

While today’s airdrop rules have become more sophisticated in their screening mechanisms, they all share one common trait - they’re still fabricating stories to brag about.

History keeps repeating itself.