DuckChain🦆: L2 on TON, aiming to tokenize Telegram Star, but the TON Foundation is absent.

• By vski5 • 4 minutes readTable of Contents

DuckChain Project Analysis

Fundamentals

DuckChain, an L2 solution built on TON and Telegram Mini App, aims to tokenize Telegram Star tokens on TON, but lacks support from the Telegram Foundation.

It has completed a $5 million funding round, with investors including dao5, Kenetic Capital, Arbitrum, Oak Grove Ventures, Skyland Ventures, GeekCartel, Gate.io, DWF Ventures, Presto, Rob Viglione, Richard Ma, and Iron Boots.

The ecosystem’s SWAP and DeFi features haven’t been developed yet, so it can be speculated that TGE will directly list tokens on certain DEXs.

NFT

To facilitate airdrop rules for the project, equity NFTs have been issued. As with most projects offering NFT airdrops, in order to accommodate pump-and-dump schemes, 1,000 Memberships were specially set aside for the Early Bird Round (Whitelist Only).

For all holders, the DUCKchain project has raised only $5M, and expects to generate 1660 ETH from NFT sales. At an ETH price of $3680 per unit, this translates to approximately $6M in revenue. However, considering the easily accessible 10% discount, the estimated revenue is 1660 ETH * 0.9, equating to around $5.4M. The project could theoretically break even from NFT sales alone.

If they can’t even sell the NFTs, or are unwilling to purchase the NFTs themselves to create data, this small-scale project is likely to fail quickly.

Two Key Points Mentioned in NFT Rights:

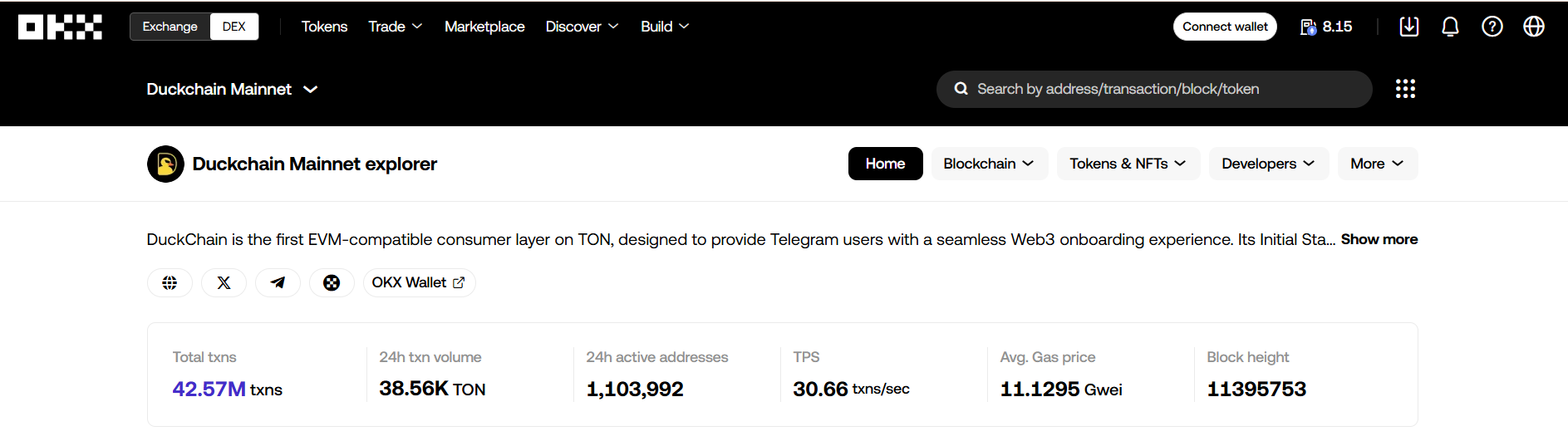

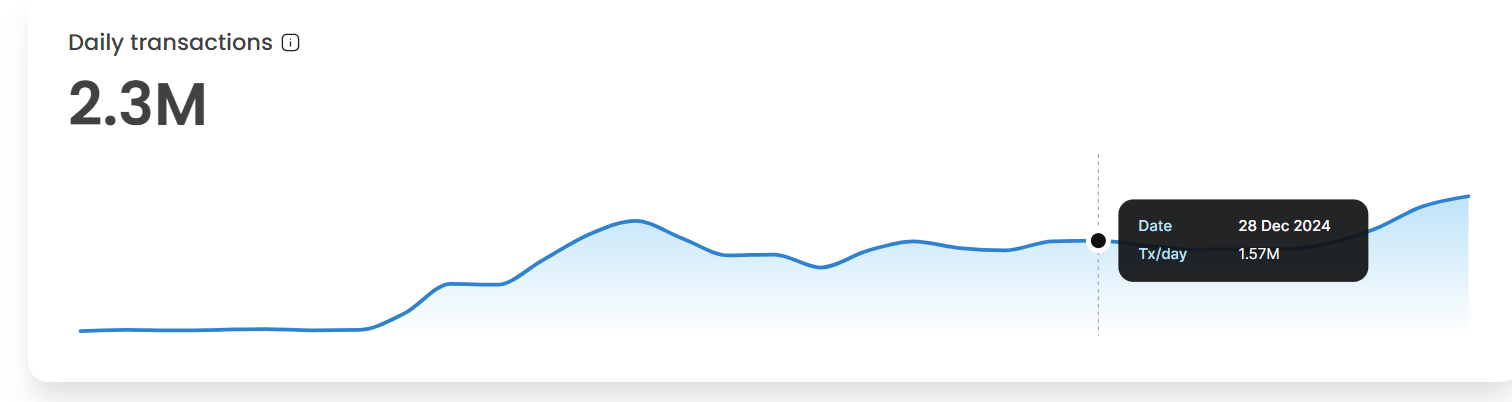

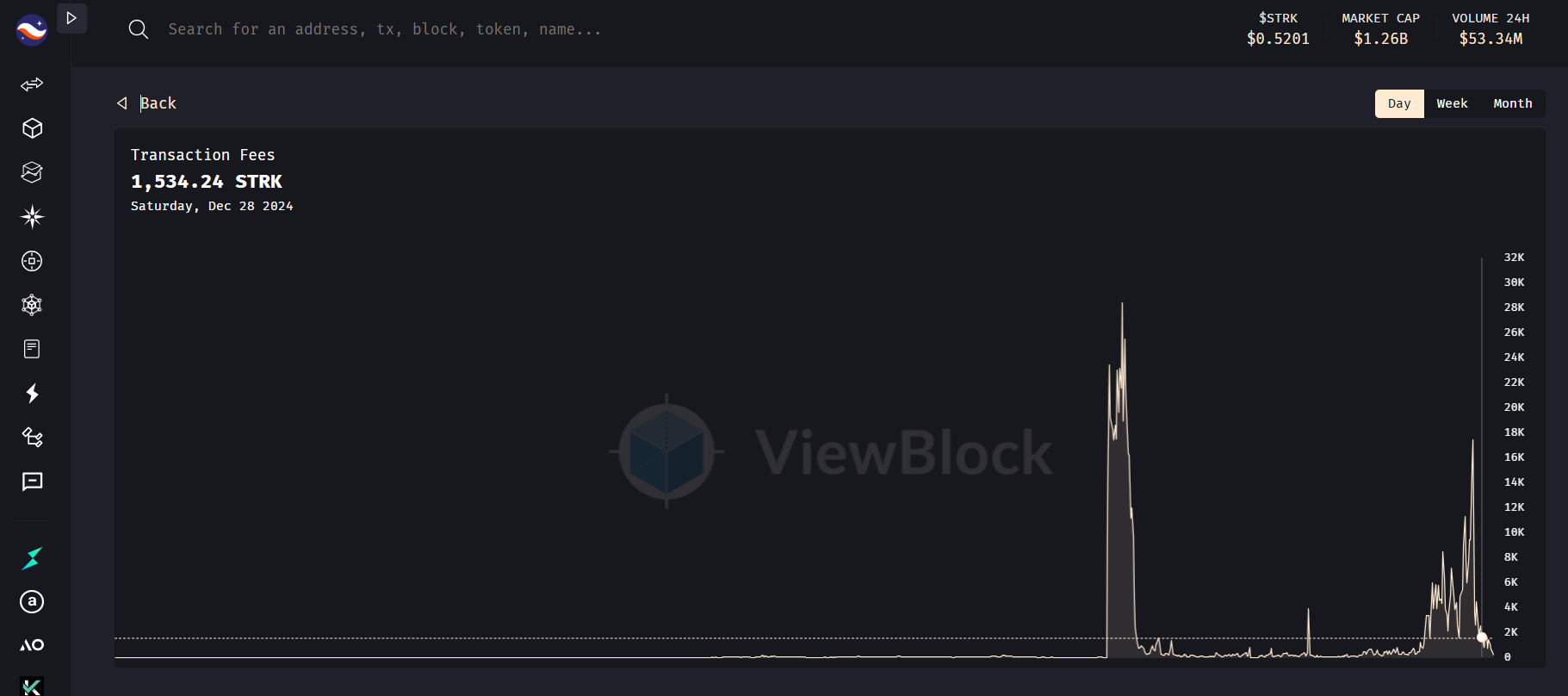

The first point is that 50% of DuckChain’s on-chain transaction revenue will be distributed as ongoing income for NFT holders. Before the TGE, based solely on gas fees, and considering that the gas activity was obviously affected by bots, assuming similar transaction volume can be maintained later—without encountering a situation like Starknet, where transaction volume almost dropped to zero after the TGE—the earnings calculation based on current data (while excluding bot-driven transactions and official transfers of Duck Star, which account for nearly all of the transaction volume) is roughly as follows:

- The potential 24H L2 gas earnings would be 38.56K * 11.1295 GWei TON (at the current exchange rate, 1 TON is about $5.71, totaling approximately 0.00000346 TON, which equals about $0.0000197). If 50% of these earnings are shared among 20,000 addresses, the future NFT gas fee earnings are virtually negligible.

- The other part of the income comes from staking fees, DuckSwap, and other potential official DApp transaction fees.. The contract 0xf40cc66dc41f5b95fcb0fd8f1d68105a279aaf15 is almost the only contract on-chain, and I suspect it is the main source of income for the project to sustain its operations. Looking at the highest 20 fees for staking, each transaction amounts to just 0.00313048 TON ($0.01). This fee is high and unreasonable for users, and for the project and any potential stakeholders sharing the revenue, the amount is pitifully low.

The second point is that holders will receive initial $DUCK tokens during the TGE and will continue to earn token rewards by actively participating in governance. Clearly, at this stage, the value of holding is only significant before the TGE.

But in an ecosystem that has little development, with the only two features being TON L2 and the tokenization of Telegram Star tokens, and the L2 lacking support from the Telegram Foundation, is there any real value to the generated earnings?

NFT Sales

DuckChain’s NFT sales are divided into three rounds:

- Early Bird Round: 0.06 ETH, 1,000 pieces

- Second Round: 0.08 ETH, 10,000 pieces

- General Round: 0.1 ETH, 2,000 pieces

Riding on the AI trend, DuckChain launched the AI DAO Genesis Program, combining AI agents to optimize blockchain governance, but it lacks direct support from the Telegram Foundation.

Leveraging KOLs, this also ties into the 10% OFF strategy I mentioned earlier—anyone can generate their own invitation code to purchase discounted NFTs, and KOLs can include their discount links in airdrop tutorials 🔗.

Sales are primarily conducted via Arbitrum, indicating that while the project is based on TON, it hasn’t fully leveraged TON for its main profit-making activities, instead relying more on Ethereum’s Layer 2 solution, Arbitrum, creating a fragmented ecosystem.

The sales strategy clearly relies on airdrops and early reward mechanisms, aiming to attract users with low initial prices and boost market participation via airdrops.

At this point, it’s safe to say that the value of the NFTs is only apparent during the moment of the TGE, with no lasting value for holders. The project team is even too lazy to generate simple images for NFTs using AI, which shows their lack of effort.

Technical Details and Innovation

AI-driven DAO governance simplifies the decision-making process by introducing AI agents and AI certificates, thereby improving governance efficiency. AI agents are able to conduct deep analysis of proposals, assess community sentiment, and participate in voting, ensuring that the governance system is both intelligent and decentralized.

- This sounds like the users’ decisions are being handled by AI agents—so what does that mean for the significance of user decision-making?

Although DuckChain did not receive direct investment support from the Telegram Foundation, it can still stake Telegram’s currency—Star⭐—on the TON network. This mechanism not only gives Star higher liquidity but also enhances its practical application value within the DuckChain ecosystem.

- I believe this is a crucial way to attract capital, effectively addressing the earnings issue for Telegram Star⭐ holders.

- Perhaps through future cross-chain mechanisms, Telegram Star⭐ could be used on ETH or other chains as a stablecoin or part of a risk-hedging currency.