What I'm Reading This Week (2025/03.23-03.30)

• By vski5 • 7 minutes readTable of Contents

Trends

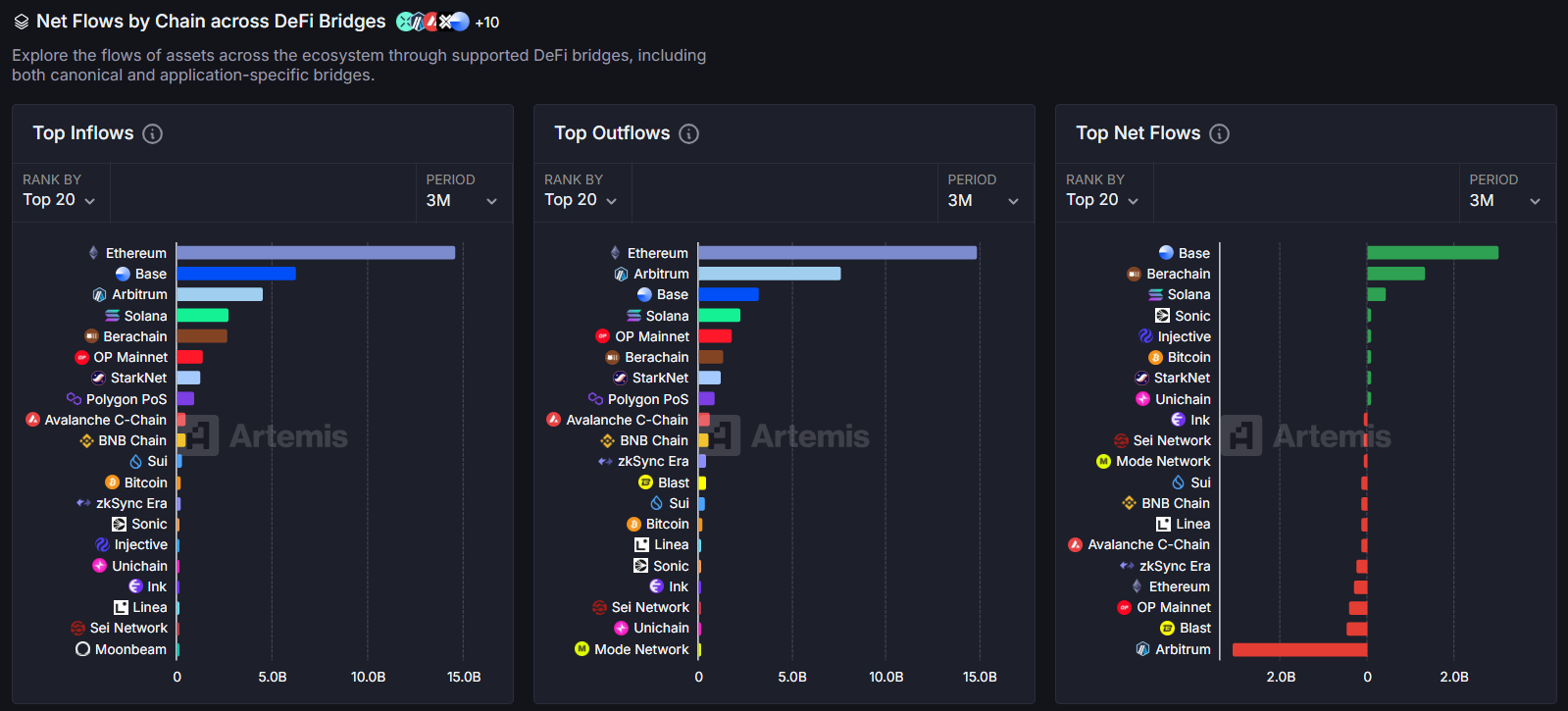

Sonic’s founder claims that BASE’s inflow comes from USDC and cbBTC minted by Coinbase. If this chart shows pure bridging, then the reality of Base might be rapidly increasing rather than what AC claims.

What I Am Reading

A week of seeking opportunities in berachain and soniclabs, but found none.

Recommend a berachain news aggregator: t.me/bitalknewsinfor

1. HSBC Peng Fu’s Speech: Banking Industry Insider’s View on Chinese Economy

- Generated using notebooklm.google.com

II. Mr. Fu Peng’s Keynote Speech: “2024 Year-End Review and 2025 Outlook - Risk Hedging VS Soft Landing”:

1. Basic Framework

- Official Information and Long-term Trends: Focus on official channel information, pay attention to long-term trends rather than short-term fluctuations.

- World Pattern Changed Completely from 2016: 2016 (Trump’s first election) marked the beginning of de-globalization and right-wing trends.

- Importance of First-hand Research: Emphasizes field research over online information, including AI-generated content, believing widely circulated information may be inaccurate.

2. Global Political and Economic Pattern Transformation

- Global Right-wing Shift: World countries have trended towards right-wing politics over the past 5-6 years, manifested in increased political importance, return to traditional voting, and rising anti-immigration sentiment.

- Impact of Trump’s Return: More right-wing than 2016, core issue is bipartisan pressure on China-US relations, just with different focuses.

- World Economic Understanding Levels: Forms pyramid structure from bottom-level asset markets, macroeconomics, politics to top-level ideology, biggest economic cycle changes stem from ideological shifts.

- “Once in a Century Great Changes”: Current global situation similar to complete cycle ending from 1929 Great Depression to post-WWII, restarting right-wing trend.

- Left-right Ideology Essence: Simply understood as left showing inclusion and integration, right showing self-centeredness; global left-wing promotes globalization and common growth, global right-wing leads to conflict or even war.

3. Chinese Economy Analysis

- Consumption Downgrade Trend: Obvious consumption downgrade phenomenon observed, middle class starting to economize.

- Continuous Negative PPI: Indicates declining enterprise profits, trapped in fierce price wars and vicious competition, possibly no winners under demand contraction.

- Coexistence of Oversupply and Insufficient Demand: Current economy faces dual problems of oversupply and insufficient effective demand, needs wealth redistribution to boost domestic demand.

- Post-80s Generation as China’s Core Domestic Demand: Post-Cultural Revolution baby boom generation (post-80s) is main driver of China’s huge domestic demand, but their leverage capacity has reached limit.

- 2008-style Stimulus Measures No Longer Effective: Current measures to stimulate economy through relaxing real estate purchase restrictions unlikely to produce 2008-like effects, as post-80s generation has reached leverage limit.

- Truth about “Domestic Debt is Not Debt”: Essentially government’s taxation rights over domestic residents, without population or income growth, can only manage domestic debt through higher tax rates.

- Government Debt-driven Infrastructure Investment Logic: Government infrastructure investment theoretically reasonable if taxes collected (direct or indirect like land transfer fees), but large-scale infrastructure difficult to sustain as young population decreases, shrinking tax base.

- Internationalization and Overseas Taxation: Limited domestic tax base growth, China’s internationalization can be seen as effort to obtain overseas tax revenue.

- Household Sector Leverage Assessment: Simple comparison of Chinese household leverage with high-welfare countries misleading, as Chinese families bear higher self-paid expenses for education, healthcare, retirement.

4. Investment Strategy Recommendations

- Government-guided Industry Investment Timing: Invest early in government-supported emerging industries, exit when market enthusiasm peaks.

- Semiconductor Industry Status: Currently in early government support stage (J stage), will continue receiving strong support.

- Domestic Structural Opportunities: Focus on wealth extremes: serving very wealthy (high-end luxury) and extremely price-sensitive groups (budget brands); attention to young and elderly consumption, avoid debt-heavy middle-aged groups.

- Overseas Asset Allocation:

- Emerging market bonds (mainly China): Early high-interest lending opportunities

- US stocks: Optimistic long-term but cautious short-term, recommend DCA strategy to avoid high volatility

- Buffett’s cash holdings should be understood as “4.5% dividend stocks with zero volatility” rather than signal of market pessimism

5. Global Risk Warnings

- War Risk and De-globalization: Global war risks increasing, asset valuations beginning to consider war and decoupling risks.

- US Interest Rates and Emerging Markets Relationship: Emerging market crises not only caused by US rate hikes, also depends on relative levels of domestic investment returns vs US rates and debt conditions.

- Monetary Stability in Low Interest Rate and Fiscal Expansion Environment: Only developed economies like US, Europe, Japan can support currency stability through overseas asset returns (carry trade).

III. Interpretation of Japanese Economic Conditions:

- Japan’s 35-year Cycle End: Japanese stock market finally broke 35-year record this year, due to intergenerational wealth redistribution (older generation’s death naturally increasing younger generation’s proportion).

- Relationship Between Economic Growth and Comfortable Living: Through wealth redistribution, comfortable living possible even without economic growth.

- Buffett’s Motivation for Investing in Japanese Trading Companies: Participating in redistribution of Japan’s past 40 years’ accumulated wealth, especially their overseas arbitrage trading income.

- Plaza Accord Impact: Unlike common belief, Plaza Accord not sole reason for Japan’s economic decline, right-wing nationalist policymakers unwilling to acknowledge own policy defects. Strong yen and low interest rates led Japan to invest in overseas assets, government debt used for social welfare, though no growth but relatively comfortable living conditions.

IV. Chinese Economic Operation Characteristics and Market Response

- China’s Securities Market Accurately Reflects Economy: Securities market (excluding Shanghai Composite Index) structural trends accurately reflect economic reality, real estate and traditional consumption sectors ended, semiconductors become one of few expanding sectors.

- “No Increment, Only Structure”: After high growth period ends, focus shifts to understanding and grasping structural economic change opportunities.

- “JQK” Model Analysis of Chinese Economy:

- “J” (Come on, Sir): Attracting investment

- “Q” (Please invest, Sir): Locking in capital

- “K” (Get out, KO): Eliminating competitors

- National development logic is “having it” rather than short-term profit, government supports early industry development, reduces support after achieving “far ahead” position, shifts to market competition.

V. Wealth Redistribution and Resident Consumption

- Real Estate Wealth Effect and Consumption Disconnect: After 2015-2016 stock market crash, housing prices rose sharply, creating temporary wealth illusion and driving consumption not dependent on income growth.

- Intergenerational Debt Transfer: Older generation selling high-priced houses to young people, essentially taking young people’s next 40 years’ income present cash value.

- End of Consumption Upgrade Cycle: Rapid consumption upgrade cycle driven by post-80s leverage consumption has ended, younger generation’s consumption habits more practical and convenient.

- Necessity of Going Overseas Strategy: Facing insufficient domestic demand, Chinese enterprises only have “going overseas” growth path left, but current global right-wing environment unfriendly to this.

VI. Views on Real Estate and Stock Market

- Misconception about Stock Market Creating National Wealth: Stock market prosperity alone cannot change national fortune, without real value creation, pure trading only results in “rich get richer, poor get poorer”.

- Asset Bubbles Should Not Be Viewed as Household Wealth: Warning against treating asset price bubbles as real household wealth, such wealth effects not lasting.

- Limitations of Intergenerational Wealth Transfer Through Stock Market: Difficult for young people to obtain wealth from older generation through stock trading, practical strategy might be other forms of wealth transfer.

VII. Observations on US and Global Economy

- US is Rebuilding: America under Trump experiencing reconstruction, suggesting Democratic policies viewed as excessively left-wing, leading to growth, inflation, and high interest rate environment.

- Global Investors Should Remain Neutral: Global investors should avoid ideological bias, need to understand left-right global trends’ impact on investment strategy, not taking sides.

- US-China Relations: Pressure on China exists regardless of Democratic or Republican party, just different focuses (diplomatic or economic).

VIII. Future Outlook and Risk Warnings

- Dangers of Major Cycle End: Emphasizes current economic major cycle end is significant event, first experience of such cyclical downturn for many Chinese investors.

- Monetary Policy and Exchange Rate Balance: China faces balance between interest rates, fiscal policy, and exchange rates, might lower rates, allow currency depreciation, and increase fiscal spending in severe trade war situation.

- Whether China Will Repeat Japan’s Path: Considers question too general, huge differences between China and Japan in various areas, but Chinese household sector might basically replicate Japanese experience.

- Policy Response Recommendations: Supports deleveraging economic stimulus policies (like reducing existing mortgage rates), opposes continued leveraging (like reducing down payment ratios) as household leverage at limit.

Link

Original text hyperlink and QR code