What I'm Reading This Week (2025/02.02-02.08)

• By vski5 • 3 minutes readTable of Contents

Trends

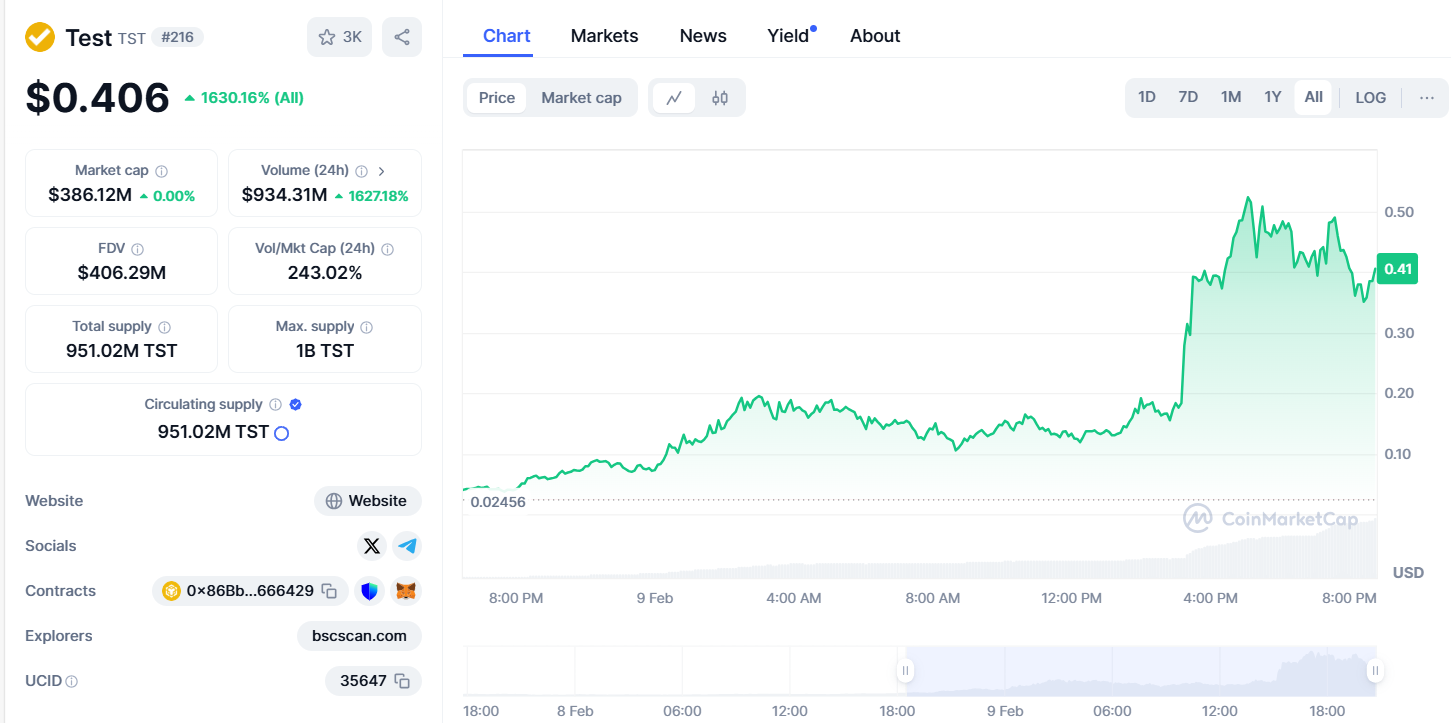

CZ launched a new platform called Four.meme on BSC, similar to PUMP.FUM.

After posting the contract address (CA) of a test token called TST, he gained attention and support by repeatedly stating it was just a test token and emphasizing there was no intention of market manipulation.

Perhaps as a strategic response to regulatory pressure, CZ is trying to find new opportunities at the edge of compliance, revitalize the BSC ecosystem, and create new speculative platforms.

TST was listed on Binance alpha shortly after CZ’s promotion, followed by a listing on the Binance exchange. CZ urgently needs a wealth creation narrative to attract users.

Notably, news about CZ’s mistress Heyi (who has children with him) and her circle of friends manipulating Binance Labs has been circulating in the Chinese internet.

What I Am Reading

There have been too many stories lately about people getting rich from meme coins on Solana, like a pre-crash carnival.

CZ couldn’t succeed with pumpfun on BSC because it was just a one-time celebration, as the issued cheems and tst tokens caused large blocks on BSC, and the network has started to become congested.

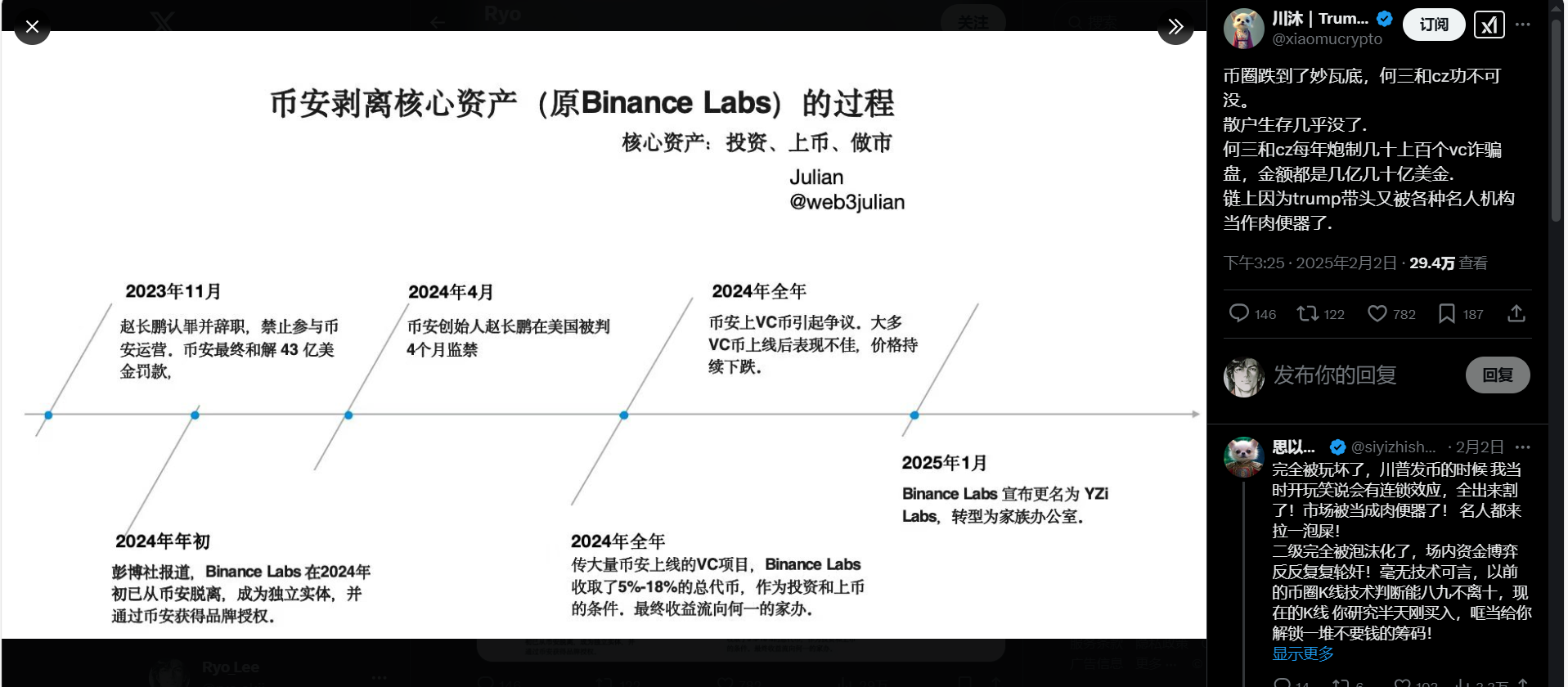

1. CZ’s Mistress Heyi (Mother of His Children) and Her Friends Manipulating Binance Labs

- Binance Labs has been renamed to YZi Labs, which both circumvents regulatory scrutiny after Binance’s issues and indicates that actual control has shifted to Heyi (and her friends)

- The process of Binance separating from Binance Labs

CZ pleads guilty and resigns, is banned from operating Binance, and Binance settles with a $4.3 billion fine.

CZ begins serving his 4-month prison sentence in the US.

Binance's VC token listings cause controversy, with most VC tokens performing poorly and prices continuously declining.

Binance Labs announces rebranding to YZi Labs, transforming into a family office.

- This is a debate sparked by Chinese crypto teams’ accusations against Heyi

- It points out that Heyi’s friends (such as Ella Zhang) list their held tokens on Binance, then use Binance’s trading depth to dump and exit positions. How they acquire their initial positions is generally believed to be through collusion with project teams who provide tokens in exchange.

- Recently, tokens listed on Binance are being dumped upon listing. The simplest reaction to this ongoing situation is that BERA’s short interest rate reached 2% per 4 hours right after listing, forcing everyone to join the short-selling hedging strategy.

- Heyi’s explanation

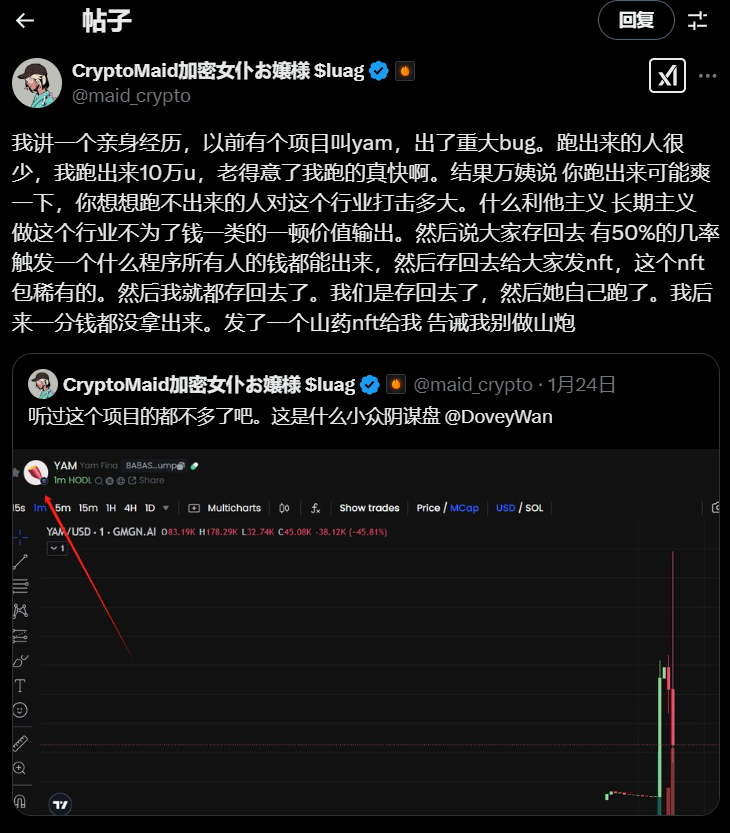

- It was precisely because Heyi came out to explain that I saw numerous related replies confirming the situation, such as how Heyi’s friend Dovey Wan convinced lucky investors who had escaped from the troubled YUM project to reinvest their money, only to escape herself.

- It was precisely because Heyi came out to explain that I saw numerous related replies confirming the situation, such as how Heyi’s friend Dovey Wan convinced lucky investors who had escaped from the troubled YUM project to reinvest their money, only to escape herself.

Link

Original text hyperlink and QR code