What I'm Reading This Week (2024/9.29-10.05)

• By vski5 • 3 minutes readTable of Contents

Trends

This week is China’s National Day holiday, and the stock market is closed for trading. Before the holiday, thousands of stocks hit their daily limit up, and the hottest topic on Chinese social media is whether the A-shares will continue to rise after the holiday.

It’s worth recalling that before the China Securities Regulatory Commission announced the suspension of off-market margin trading access and required brokers to clean up off-market margin trading in 2015, the market had experienced a comprehensive rise.

During the 2015 stock market crash, CITIC Securities was investigated for allegedly collaborating with foreign investors to short the market, and was still penalized for this in 2017. It wasn’t until November 5, 2018, that the case closure notice declared that the alleged illegal facts in the margin trading business of CITIC Securities and Citadel (whose major shareholder is one of the world’s largest hedge funds) were unfounded.

I’m curious about what CITIC Securities’ short-selling ratio will be after the holiday.

CSI 300 Index (sh.000300)

CSI 500 Index (sh.000905)

ChiNext Index (sz.399006)

Trading Volume Trend

Price Trend (pctChg)

What I’m Reading This Week (2024/9.29-10.05)

Good morning, this is the first week of October 2024.

This week is China’s National Day holiday, and I’m at home watching tourist attractions crowded with people.

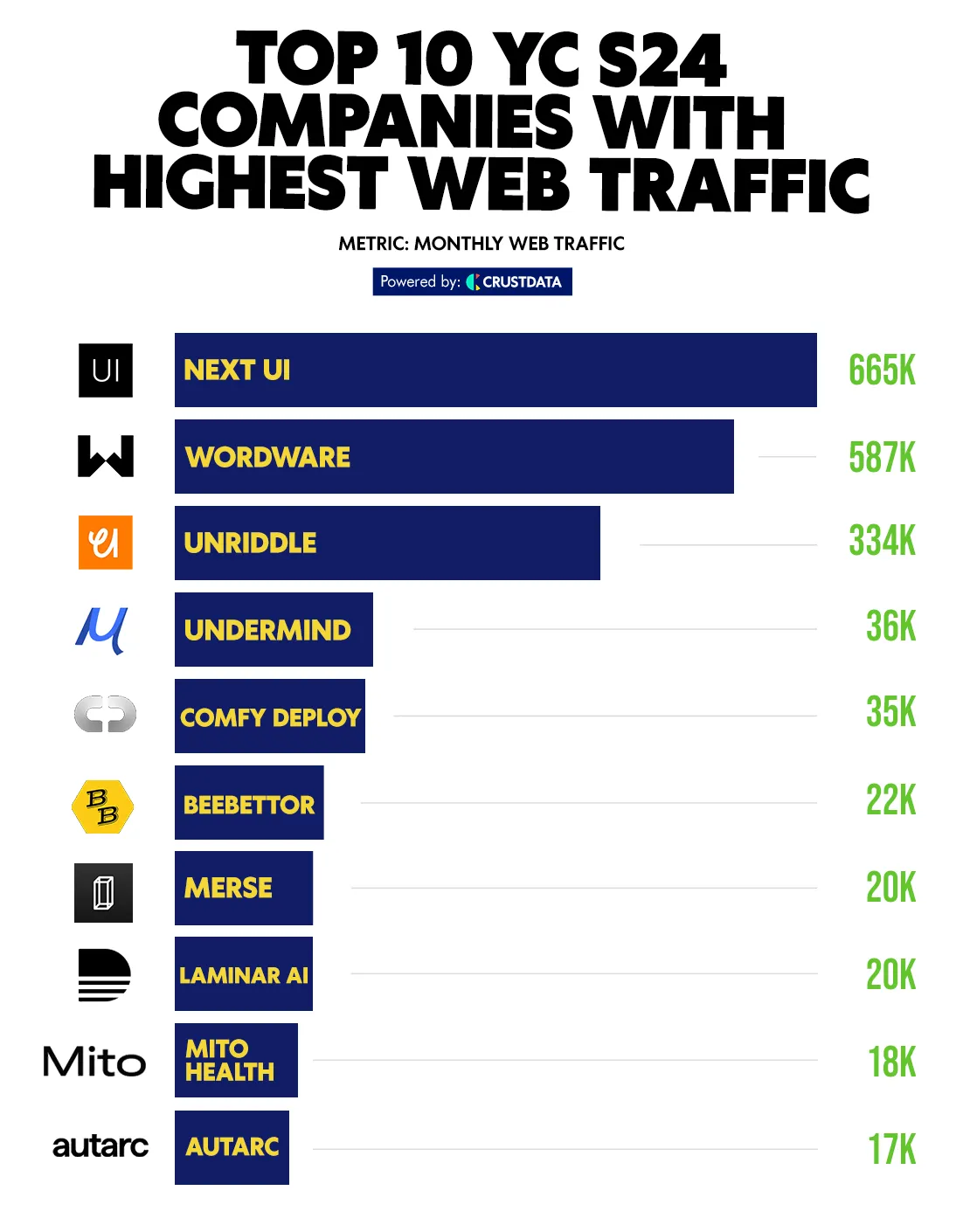

1. 2024 YC Top Companies list

The 2024 YC Top Companies list has been released, listing the YC-incubated companies with the highest revenue in 2023,

Total revenue in 2023: $57.2B

Collective valuation: $458B

Industry distribution:

- B2B software and services: 52%

- Consumer: 23%

- Fintech and services: 19%

- Healthcare: 2%

- Bio and industrial: 2%

- Real estate and construction: 2%

Other data:

- 27% of companies (13) have exited, 11 are public companies

- Total employees of companies exceed 80,000

- Over 50% of companies are headquartered in the Bay Area

- Over 90% of companies were founded by two or more co-founders

- Oldest company: Reddit (YC S05)

- Youngest company: Zepto (YC W21)

- S12 batch performed best, with 5 companies on the list: Benchling, Coinbase, Instacart, SmartAsset and Zapier

Companies newly added to the 2024 revenue list:

- Clipboard Health: Connects healthcare facilities with nearby nurses

- Honeylove: Innovative shapewear

- Meesho: India’s internet e-commerce democratization platform

- Odeko: Software for cafe operations and growth

- Razorpay: India’s comprehensive financial solutions

- Zepto: India’s 10-minute grocery delivery service

2. NASA at a Crossroads

Challenges facing NASA

- Aging workforce

- Infrastructure aging beyond expected lifespan, threatening operational capabilities

- Difficulty retaining talent (engineers attracted by high salaries in private space sector)

- Over-reliance on private companies may lead to loss of internal expertise

- Resource constraints (despite budget increases, modern mission complexity is rising)

- Budget gap of about $3 billion

- Pressure leads to focus on short-term missions, neglecting long-term strategic planning

Comparison of past and present

- Apollo era:

- Large taxpayer investment, thriving development, achieving ambitious goals

- Now:

- Insufficient funding, aging infrastructure

- China’s growing space program poses a potential threat to NASA’s leadership

- NASA needs to adapt and evolve to maintain global leadership

- Apollo era:

Main findings of the report

- Focus on short-term missions may hinder long-term success

- Recommendations:

- Prioritize strategic thinking

- Invest in technology development and employee training

- Consider canceling or postponing costly missions

- Need to balance ambitious goals with available budget

Future outlook

- Call for a change in approach, more focus on long-term planning

- Increase investment in infrastructure, technology development, and employee training

- May need to reconsider or postpone expensive missions to free up resources

- Report provides guidance for future NASA leaders, emphasizing necessary changes to ensure long-term success

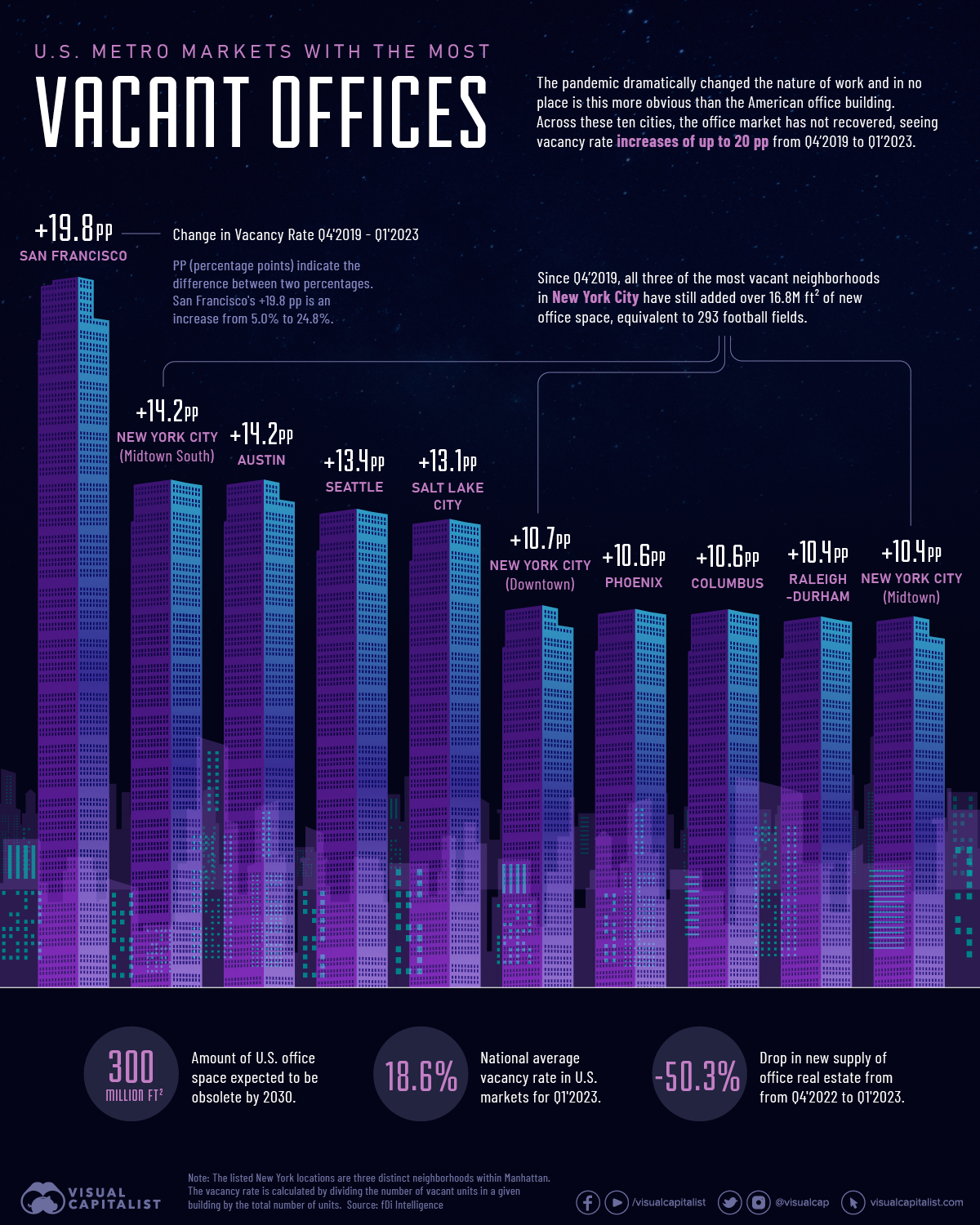

3. Ranking: U.S. Cities with the Most Vacant Offices

Link

Original text hyperlink and QR code